LITUS Insurance

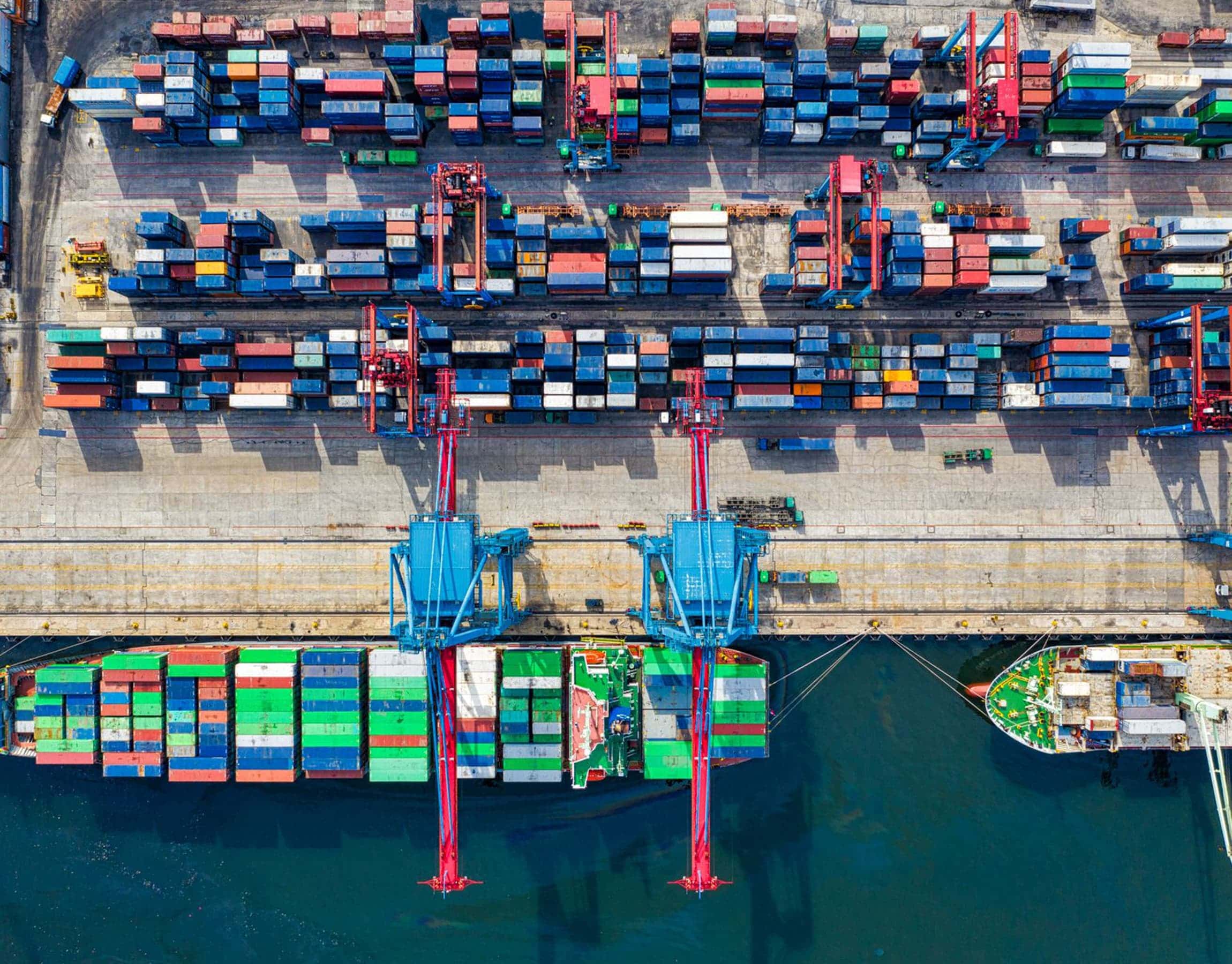

LITUS srl is an independent Underwriting Agency that provides special insurance coverage for Marine Cargo and e-commerce with International Insurers using innovative solutions and tools.

In a world where if you don't keep up with fast-paced digitalization, "falling behind" makes the difference between continuing to operate or failing. The insurance sector often relies on antiquated intrastructures and technological systems, and given the delicacy and importance of the information being handled, it is increasingly necessary to rely on advanced, modern digital systems capable of communicating and exchanging information.

The LITUS Insurance project aims to build an insurtech platform that meets precisely these needs, which are essential for keeping pace and offering a distinctive service in the international insurance landscape.

%%gallery%%

Talking about the project

The first step is to communicate your mission to others with a clear, effective and, above all, different look and value proposition.

For LITUS Insurance we have studied a characteristic brand identity, which knows how to combine the seriousness and professionalism typical of the insurance sector with the freshness of more modern and youthful contexts such as those of e-commerce, another fundamental point that distinguishes the LITUS Insurance offer.

The study led to the creation of an institutional website that could convey the company's offer in a structured and well-organized way, and therefore allow the LITUS Insurance team to cluster the leads received based on needs such as requests for information, opening of claims, insights into policies through dedicated online configurators.

%%gallery%%

Thinking scalable

The point that makes the difference, however, lies at the heart of the project: the policy and claims management platform.

To allow LITUS Insurance to keep up with the times and have an edge over the competition, we have created the technological platform with a modular and API-based approach, allowing it to position itself with an innovative offer in the insurtech landscape and be ready for digitalization of the sector.